The Startup Engineering blog is shifting over to the Flashpoint website: http://flashpoint.gatech.edu.

Merrick and I are excited to be entering a new stage with Startup Engineering – supporting company creation both inside and outside of Georgia Tech.

We’ll post links here for a while, but the new stuff will be happening here.

Osterwalder’s business model canvas is a picture of a business, a way to parse it out so that startups can figure out whether their fantasy can be real, and investors, brokers, and other interested parties can gauge the strengths and weaknesses of an established business.

One of the big weaknesses a business can have, the ur weakness, is a failure to make money. If the revenue from customer box is lower, or on track to be lower, than all the costs associated with the other boxes, then the business is effectively destroying value.

Social enterprises, though, aren’t obviously sustainable in that way, because the end users, or customers, normally can’t pay at all, or can’t pay the full costs of, the value provided. If they could, then the value a social enterprise seeks to offer could be offered on a commercial basis and you wouldn’t need a social enterprise at all.

There’s an answer to this, though. Lots of for-profit companies, Google’s a good example, have a two-sided customer model. Google’s customers are the hundreds of millions of people who do internet searches for free, but they have another category of customers: the millions of businesses that pay to put ads in front of that first group. Providing what the free customers want creates value for the paying customers.

It’s the same way with social enterprises. Frequently, social enterprises have both end user customers, like poor women in Ecuador who need skills, or farmers in South Sudan who need electricity, or homeless people in New York who need homes. If these people could pay market rate for what they need, then a commercial business could provide it for them – that’s the social enterprise raison d’etre.

But they also have paying customers, like Skoll and Rockefeller and USAID and all those people who contribute on Kickstarter. Those are customers too. They are buying something, some change in the world that need to buy, in order for them to be what they’re meant to be. A sustainable social enterprise is one that can reliably and repeatably meet the authentic demand from their two sets of customers, and through doing that, generate enough money to keep going.

In the movie business, “production assistant” is the purest of entry-level, grunt-work jobs. Here’s one description of the work involved:

“Job duties could include things like “locking up” (making sure no one walks on set) and calling out “Cut” and “Rolling” as they come across the radio. They could be “running talent” or background, helping distribute paperwork and walkies, picking up trash, managing the craft service table, fetching anything people ask for, going on coffee runs, and doing whatever the ADs tell them… which could be just about anything.”

Whatever their activities, what production assistants are really doing is making it possible for the assistant directors (ADs) to do their jobs, which make it possible for the actors and directors to do their jobs, which make it possible for the producer to do her job, which is to make a movie.

Every company is a production assistant, and every customer is a producer.

Thinking of customers – consumers, after all – as producers, clarifies the path to customer discovery. Here’s why:

When you think of customers as consumers, a hulking, shape-shifting ambiguity, like a special-effects demon out of a Harry Potter movie, blocks the path to discovering demand. After all, here’s what you want to discover: what drives customers to choose your thing, among the zillions of things they can do and things they can buy? Is the key driver their age or sex? Their religious background? Their left-handedness? Their desire for higher social status? Their job title? Their careful analysis of price and features? Their love of the color orange? Not only are there infinite possible decision drivers, there are infinite categories of possible drivers, and the buying decision may very well arise out of some combination of these infinite, uncategorizable factors.

Even worse, you can’t figure it out by asking them. People don’t know why they do things. Some of them spend years in therapy trying to figure that out. Remember the last couple of things you bought yourself: do you really know why you bought them? Well enough that you could write down a formula to accurately predict your future buying behavior? The last three things I bought were:

1) Twisted Berry fruit & veggie blend juice

2) Milano melts mint chocolate cookies

3) Sweet chipotle jerky

I have only the vaguest notion of why I bought (and ate!) those particular things. And that’s questioning my own brain – the results get worse when you have to communicate with someone else.

So, you’ve got an ambiguous mess of un-sort-outable possible drivers for buying behavior, and an extremely problematic method for sorting them all out. Good luck market researching your way past that demon.

But think of your customers as producers, and – expecto patronum! – the demon dissolves and the path magically clears. Here’s why:

Every customer has a job to do. Remember: customers are people, or aspects of people. It doesn’t matter if you’re selling B-to-B or B-to-C. In either case, you are presenting your product or service to human beings who make decisions within their context (whether the context is social or workplace or family or anything.) It doesn’t matter if you are selling a game app to a teenager or an airport to a city. In either case, someone has a job to do (whether it’s entertaining themselves or landing airplanes.) Just like a producer has to produce a movie, your customer has to produce an entertained self, or a landed airplane, or whatever it is. And you? You’re their production assistant. Your job is to enable them to do it.

Your first job, though, as a startup, is to figure out what they need to produce, and what’s stopping them from having produced it already. That’s what customer discovery is: discovering what your customers need to produce, and what’s stopping them. The first half of this formula is essential, but the second part is the key. Think back to your job as production assistant. Your boss, the assistant director, needs to get a great shot, but knowing that is only half the battle. Maybe he can’t get that great shot because the wind machine isn’t blowing hard enough, or there’s shit on the sidewalk, or the actor didn’t get his favorite coffee in the morning. There are still a million possibilities, but because you know what the job is, you can test for and eliminate impediments. So now, you’re confronted with a lot of work to actually do that, but you’re no longer confronted with the demon of ambiguous motivations and impossible questions.

Now, you are on a path to becoming the thing that enables your customer to produce what they need to produce. Stardom’s right around the corner.

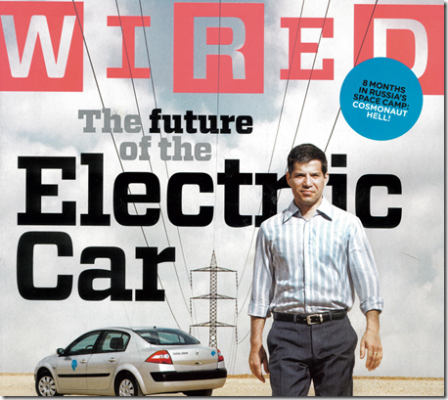

Since the bankruptcy last month, it’s easy to second-guess Shai Agassi about Better Place– the Webvan-sized fiasco of the electric car world. A total of $850 million was invested in the company since it was founded in 2007, most of which is now going down the drain. How could this have happened? The problem Better Place addressed was (and still is) widely believed to be real. The solution was brilliant and compelling.

Problem: People don’t want electric cars because they’re more expensive and less convenient than gas-powered cars. (Note: Both issues stem from the battery; batteries cost a lot, don’t provide enough range, and take too long to recharge.)

Solution: Separate the battery from the car, both physically and as an asset. Physically, make the battery generic and swappable, like propane tanks for gas grills. Drivers can pull into a station, swap out their depleted battery for a fully charged one, and be one their way; which makes driving the cars convenient. Financially, sell people the cars, but retain the batteries as an asset of the company, leased to drivers. This makes the cars affordable. Eventually, Agassi hoped to give the cars away, and sell miles driven instead of cars. It’s the razor-and-razor blade, phone-and-minutes, printer-and-ink cartridge business model, poised to transform the auto industry.

So what went wrong? A survey of post-mortems highlights five possible answers:

1) The business model was too high-risk because costs were front-loaded. Better Place had to build dozens of $500,000 robotic battery switching stations before they could start selling to customers.

2) Rather than ameliorating this problem, management compounded it by scaling too early. For example, documents revealed this week by the bankruptcy court show that Better Place bought software licenses to cover one million customers, anticipating, and paying for, an avalanche of demand that never arrived.

3) Government didn’t help. The tax treatment of car purchases in Israel undermined the attempt to drive prices down – buyers effectively had to pay tax on the whole car-and-battery package, despite the fact they were just leasing the battery. Further, local authorities put up unexpected roadblocks to building the switching stations, driving costs up and convenience down.

4) Not enough buyers bought in. Only one car company (Renault) bought into the concept and produced an electric car with a swappable battery; only 750 people in Israel, and a few elsewhere, actually bought the cars.

5) Asking people to accept a whole new business model was too great a leap. Customers didn’t trust a change-the-world approach that asked them to buy a car but lease a battery, and depend on electricity instead of gas, and look for a battery swap stations instead of gas stations, and trust a startup, even one of history’s most well-funded startups, to keep it all together.

Honestly though, explanations #1-3 are useless. Most companies try to come up with a minimum viable product – they just have trouble figuring out what “viable” means, and end up building whatever they wanted to build in the first place. Every company makes scaling choices that try to balance a bulk purchase that lowers cost of goods sold against uncertainties about demand. Every company runs into unexpected difficulties with regulation or government or something — smooth sailing is an exceedingly rare event. So in fact, evidence for each of these three explanations can be adduced for nearly any company – both the ones that fail and the ones that succeed – so what do they explain?

And how about explanation #4 – that they didn’t get enough customers? This explains even less. Failures result from too few customers in the same sense that they result from the money running out. Sure, these or proximate causes, but they aren’t root causes; they don’t explain why.

So then, why? Don’t ask.

If the customers aren’t buying, or the partners aren’t partnering, don’t ask “what’s stopping them?” Every non-action has a million parents. People lead busy, full lives doing whatever they’re doing already. If you’re running a startup with a new idea, then you’re asking potential customers to make a series of displacements. They’ve got to displace their attention, their previous decisions, their loyalty, and their current allocation or resources, and to replace all that behavior with new stuff built around what works for you.

Trying to get people to do all this is risky business. You might know everything about your half of the equation – what you’re trying to get customers to shift to. But what about the other half? What do you know about where they’re shifting from? Are you trying to shift them from a commitment to a price? From a level of comfort with a technology? From a color? A set of features? A personal history? A set of peer expectations? Once you know your customers commitments, you can understand their problems. Before that, you’re just guessing. Explanation #5 gets at this, though only obliquely. A complicated, innovative new business model isn’t necessarily bad news. But if it requires changes in a lot of different behaviors, then it multiplies risks.

Better Place started with a problem: “People don’t want electric cars because they’re more expensive and less convenient than gas-powered cars.” Ok, that is a problem, but is it the actual customer’s problem? There are good reasons to think not. On the expense front, people already buy cars at different price points that range over more than an order of magnitude. They don’t decide whether to buy a Ferrari or a Kia based on a Consumer Reports-inspired price/value comparison of the two cars. Why expect them to buy your electric car rather than some other car (which one?) that way? On the convenience front, no one every heard the phrase “range anxiety” until traditional car makers started worrying about electric cars and marketing the phrase. The fact is, lots of car buyers drive less than 30 miles or so per day, sleep at night, and have access to electricity. Electric cars aren’t objectively inconvenient for those customers, so they don’t necessarily need a network of convenient battery-swap stations.

Shai Agassi started with a problem. That problem led to an ingenious solution, one that led, unfortunately for him, his investors, and his employees, to a very challenging business model. He was right to build his solution around a problem. But he was wrong to start with a problem. Real understanding of a customer’s problem is the goal, the endpoint, of a search. It’s easy to state a compelling, plausible problem without that search. But it’s not likely to be the problem that ends up driving customers to your door.

There are a lot of people saying that the best way to create a Startup is “problem first.” Some examples:Also, this comment a month ago on Quora:We just did a Startup Weekend and instead of pitching ideas, attendees pitched problems. So much more enlightening. Almost twice the amount of pitches compared to a standard Startup Weekend.This “problem first” approach has been part of the dialog on lean entrepreneurship at least since 2009 (see the date on the Dave McClure blogpost above.)WHAT MAKES FLASHPOINT DIFFERENT?Here’s what’s different:If it’s true that you cannot rely on your reading of your customer’s rational self interest to predict their actions, then you don’t really know what constitutes a problem for them. Therefore, you can no more rely on your ability to assess the validity of a problem than you can rely on your ability to assess the value of a product idea – they are both equally mysterious until your do the work to suss them out.Moral: You can’t reduce market risk by starting with a problem rather than a product. You can only reduce market risk by doing the work to reduce market risk. Where you do that work isn’t in the domain of a solution or a problem. Maybe it’s just in the domain of something you know about, want to work in, and bring valuable skills to.

You are not who you were meant to be. That’s what makes you a customer.

I don’t mean “meant to be” in a mystical or religious sense, but in the sense of what’s constant, or persistent, about your inner self.

You’re definitely meant to breath. You’re meant to eat when you’re hungry, sleep when you’re exhausted, have shelter from the cold. Your arms and legs are meant to work like arms and legs. You’re meant to have a place in your community, to have friends and lovers, people to care for you when you’re young or old or sick. Your current role in life also contributes to who you’re meant to be. If you’re a student, you’re meant to sit in classes and learn; if you have a job, you’re meant to show up and have the skills and do the work. But lots of who you’re meant to be is more individual than all that. Your parents, teachers, religion, culture, hometown, and many other things all contributed to your inner sense of, and expectations about, yourself.

But, and here’s the thing: you’re not who you’re meant to be. You may be meant to eat but have no food, to have shelter, but the bank just foreclosed. Or you’re meant to have status or respect, but find yourself without. There’s a gap, often a yawning, terrible gap, between who you are and who’re you’re meant to be. And that gap is called “demand.” That’s the one thing, before everything else, that a startup has to discover, to earn its right to exist in the world.

Of course, there are many varieties of demand that aren’t economic. The air is free. You can’t buy love. But a big chunk of the modern world operates on an economic basis, and everything in that economy is about bridging that gap between who a group of customers are and who they are meant to be. Lots of the economy works well for lots of people. But many gaps are unfilled, and many more are papered over with solutions that don’t quite work, or create new gaps, or crumble as the world changes.

Innovations are new, better ways to fill gaps between who customers are and who they’re meant to be. The companies that thrive are the ones that enable lots of people to address big gaps. If you want to be successful, that’s where you have to start.

Watch this first:

This hilarious video is a bit of a Rorschach. Lots of people see it as a gender comment – men are practical, women are all about feelings – that sort of thing. Another view concerns our inability to see the obvious. The woman is laughable, blind to the simple solution to her problem.

There’s another view too, one that brings this little parable into the realm of startup engineering.

There’s a fantasy we have when we imagine new companies. It’s the fantasy that drove traditional economics, and got upended by Kahneman and Twerski. Economists took as given that transactions are the results of individuals with some level of relevant knowledge busily maximizing utility. I bought these shoes because they were sturdy and handsome and the right price. I do this job because it’s the correct solution to an equation balancing income and skills and location and availability. Traditional economics looks hard at scarcity and apportionment of resources and distortions in the marketplace caused by imperfections in knowledge; it averts its eyes from distortions caused by the fact that the business of living just isn’t centered on making rational judgments about utility.

Entrepreneurs do too. When we fantasize about new companies, we imagine a world without human friction. We try to solve the equation for product. What is the product, it’s features and functions and price, that people will buy? The lean movement adds value by lowering the cost of solving that equation. Lean entrepreneurs build minimum viable products and talk to lots of customers in order to look for matches without breaking the bank. “Let’s be lightweight and agile and efficient about ripening the lemons early” say the lean entrepreneurs.

But what if we’re all like the woman with the nail in her forehead? Trying to solve the equation for product for her, even in the lightest weight, minimum viable product way imaginable, is a titanic waste of time. No matter what you do, you’ll end up with some way of getting that nail out. And she’s just not in the market for a nail remover.

Startup Engineering starts with an attempt to solve for customer. This word, customer, just like the phrase “maximize utility,” misdirects us. They sound like constants, but they’re really variables, and for new companies trying to do new things, they’re mysterious as hell. The first phase of a startup is group of spelunkers in a dark cave feeling around, not for product, but for customer.

When I had a motorcycle, I also had, inevitably, a theory about motorcycle safety. The theory went like this: Motorcycle’s are about as safe as cars. On the plus side, you sit higher than in a car seat, so you can see better. Also a motorcycle is smaller, more maneuverable, and quicker than a car, all features that give the alert cyclist a better chance to maneuver out of sticky situations and avoid accidents. On the minus side, you’re not protected on a bike, so if you do have an accident, you’re likely to be much worse off than the driver of a car.

This theory served its purpose admirably. I liked riding motorcycles, and needed a reason to believe I wasn’t putting myself or my family in harm’s way. At the same time, I wanted to be realistic, which required some acknowledgement of danger.

Adducing evidence for this theory was easy. Good view? Quick? Maneuverable? Check. Check. Check. I (thankfully) never tested the part about the consequences of an accident at speed, but that stood to reason anyway. It never occurred to me, or if it did, I suppressed the thought, that I could test my theory in some other way, like by checking motorcycle accident statistics.

Startups operate on theories too. Actual businesses may or may not operate on a theoretical basis. It’s possible to have a business that simply does x and customers spend money for it, with virtually no broader view. Most of the time though, and all the time with startups, companies operate on the basis of theories. “We believe (because of X, Y, or Z) that if we do A, customers will do B.

Startups easily fall into the trap of testing the validity of the hypotheses in their business model canvas the same way I tested the validity of my theory about motorcycle safety. They take the factors that led them to the theory in the first place, and look for further evidence to support them. That evidence is almost certainly available – if it wasn’t, the entrepreneur probably wouldn’t have come up with it in the first place. Sadly, it’s not evidence that the theory is true.

This is a reason why Flashpoint asks entrepreneurs to do three things that aren’t intuitive or easy.

- Distinguish between having a theory about an aspect of your business and having a hypothesis about it. A theory describes the mechanism of how a process or transaction important to the business works (e.g. I can get people to buy my service by advertising in bus shelters.) A hypothesis is part of a plan you use to test whether the theory is correct.

- Validating your theory involves not only coming up with a good hypothesis, but also setting validation conditions before the test, rather than trying to make sense of what happens afterwards. For example, “I will put ads in three bus shelters. Each one will show a special URL with a counter. If at least ten people per week come to our site through that URL and purchase a product, I’ll judge the theory to be correct.”

- Seek to disconfirm rather than confirm the theory. In my motorcycle theory, “good view,” “quickness,” and “maneuverability” are hypothesized to be evidence that I’d be less likely to get into an accident. But I could confirm that motorcycles met those criteria all day long, and be no closer to actually knowing whether that was true. If instead I’d been (like my mother) equipped with a theory that motorcycles are VERY DANGEROUS because they tend to skid out on wet roads, I could have found plenty of evidence for that too, and been no closer to valid knowledge on the subject.A much better approach, if my theory is that motorcycles are less accident prone than cars, is to look for evidence that that isn’t true. Evidence that I’m wrong (like,say,data showing more accidents per miles driven) forces me to ask “is this piece of evidence an anomaly, or should I trust it, reject my theory, and come up with a different one?” If I go in the other direction and look for confirming evidence, than whenever I have it, I have to ask “is this piece of evidence enough to confirm my theory, or do I need to keep testing and find more?” Generally, coming up with anomalies will poke holes in your theory and lead you to abandon it, a lot faster than coming up with confirmations will prove your theory true. In practice, entrepreneurs rarely even stop to think whether the confirming evidence is enough to rely on – they believe their theory to begin with, and even minimal evidence is plenty.

The ubiquitous lean entrepreneurship catchphrase, “get out of the building and test” is a great start. But following that advice doesn’t make your business valid, any more than getting accepted into medical school makes you a doctor.

A very perceptive, connected, media savvy, friend just wrote some nonsense to me about the terrible events in Boston over the last few days. He wrote ” who would have thought that the blow-back from Chechnya would come to America in the form of an attack on the Boston Marathon?”

Chechnya? I’d be extremely surprised. There’s a well studied

cognitive illusion called WYSIWTI (what you see is what there is)

that’s been playing throughout this sad event. When the bombs went

off, I heard media speculation that it was tax day, so it must be a

right wing anti tax nut, and that the bomb was placed on the ground

where it would cause maximum damage to legs (and at the Boston

Marathon) , so it must have been a disgruntled runner, and that it was

probable Somalia’s Al Shabab, trying to blow up Kenyan runners to maximum

effect.

The way the illusion works is this: we’re able, maybe evolved, to

form conclusions from whatever evidence is available, and we’re good

at it. We have much poorer capacity to assess the value of the

evidence we’re using and adjust how certain we are about the

conclusion. So for example, if I see someone make a dumb move on the

road, I’ll decide he’s a bad driver. An analyst at an insurance company can take

that person’s whole driving record, instrument the car, and analyze

the data about how fast he goes, how hard he hits the breaks, crunch all the numbers, look at comparables, and

decide he’s a bad driver too.

When you test my certainty about my conclusion, and the analyst’s

certainty about her conclusion, you’ll find very little difference.

As I post, we’re a moment later in the story. Two brothers of Chechen origin are alledged to have committed the crimes. One is dead, and the other now on the run. But we’re in the next phase of making the same mistakes.

The information about about Dzhokar Tsarnaev is very poor and scattered. His Facebook page mentions Islam, his family is from a war-torn part of the former Soviet Union, his uncle was quoted as saying he’s a “loser.” These are scraps of information, and anything we might conclude from them is barely more likely to be true than something we just make up out of whole cloth.

But that’s not how our minds work. The moment we form a conclusion, even on very shaky grounds, it becomes a firmly held belief.

WYSIWTI explains why it’s so painful for entrepreneurs to do the hundreds of interviews that are necessary for finding a valid business model. They’ve come to the idea that customers have problem X, and they can solve it with product Y, usually based on tiny scraps of evidence. But having reached the conclusion, the shaky ground faded from view, and asking more questions of more people began to seem like a waste of time.

Here’s a comment to an entrepreneur. He was getting signups but not good retention, and was worried that the process of testing new features to fix the problem would take forever. Thought we’d share it:

Well, retention is the right question – a lot of startups appear to go wrong by focusing on acquisition instead of retention. That doesn’t seem to work because you can only get retention through a fit between the customer’s improvement goal and your product, while you can get acquisition a number of other ways, such as a write-up in Techcrunch, that give you misleading data about what’s working.